FAQs for Self-Employed Applicants

FAQ FOR SELF-EMPLOYED APPLICANTS

If you are self-employed and you’re applying for a loan through Upgrade, please use this article as a guide on how to:

- Identify the required documentation; and

- Estimate your income for verification purposes.

Please note all information obtained will be used to verify your eligibility for a loan through Upgrade. If the recent trend in your income is lower than prior years, your qualifying income may be adjusted downward for loan qualification purposes. If we are unable to verify your qualifying income, you may be declined for a loan through Upgrade.

What if I don’t have the required documentation?

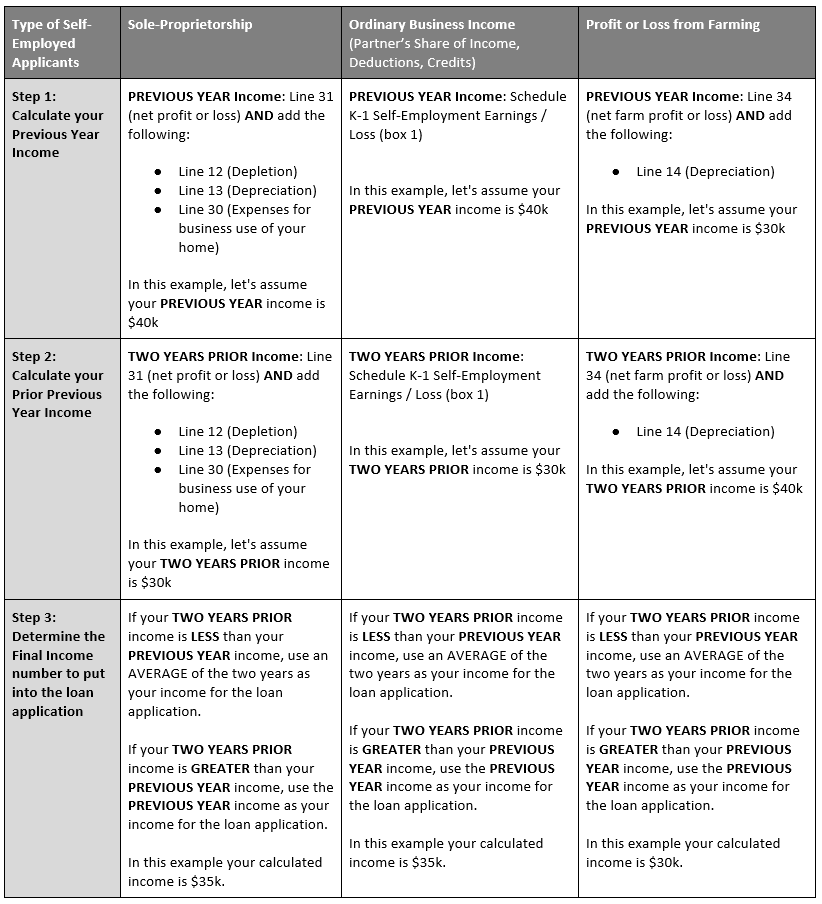

If you do not have your most recent two (2) years tax return filed, we will not be able to verify your income and your application will be denied. Please utilize the chart below to determine which documents will be required for your type of self-employment income.

***Please be aware that as of April 15th**, the tax returns required are for the previous year and the prior previous year.** Upgrade does not accept tax return extensions and your most recent years’ tax returns must already be on file with the IRS. We may verify the IRS’ receipt of your taxes via a 4506T, which may add 3-5 business days to your application time.***

Example:

- Today's Date 04/30/2021

- Previous Year: 2020

- Two Years Prior: 2019

What kind of documentation is required?

*******Please note that this is not an all-inclusive list.***

How should I calculate my self-employed income?

Articles in this section

- Are the personal loan rates fixed or variable?

- Can a personal loan or Upgrade Card be used for school?

- Can I apply by mail?

- Can I apply for another personal loan through Upgrade?

- Can I change my instructions?

- Can I include additional income?

- Can I include household income on my application?

- Can I increase my loan amount after I’ve already selected an offer?

- Can I mail my documents to you instead?

- Can I use my entire loan to pay off my credit cards?