Top 5 Factors That Affect Your Credit Score

Your credit score is the key metric that sums up your credit health, yet many people don’t realize they could’ve improved their score until they feel like it’s too late – when they learn that they didn’t qualify for the loan or are denied other services based on their credit score.

But it’s never too late – understanding the top factors affecting your credit score is one of the first steps that will help you create an actionable plan to maintain or improve your score and unlock more opportunities. To see your individual score and where you stand on each of these factors, check out Upgrade’s Credit Health.

Approximately 220 million consumers have credit files in the United States and around 36 billion pieces of credit data in total are recorded every year – that’s an average of 15 changes to each consumer’s credit file every month!1 Monitoring your credit changes is important to maintaining strong credit health or improving it, however, not all of these changes and updates to your credit report affect your credit score equally.

You can have multiple credit scores that are slightly different because there are multiple credit bureaus, different scoring methodologies, and your credit information is often updated at different times. Don’t worry about tracking every credit score. Instead, keep track of the bigger picture by understanding the breakdown of factors that impact your credit score and how they’re each generally weighted.

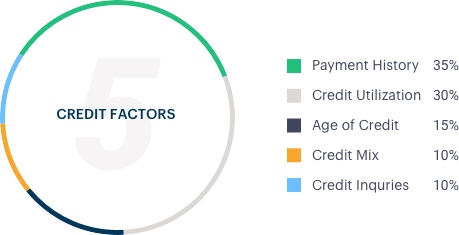

Credit Score Factors

Payment history – 35%

Your payment history is one of the most heavily weighted factors in generating your credit score because it shows lenders that you’ve been reliable in making consistent on-time payments – an indicator that you’re likely to pay back your debts in the future. For this reason, just one or two late payments could drag your score down significantly.

Multiple missed payments can turn into a “derogatory mark” on your credit report, which includes accounts in collections, bankruptcies, foreclosures and liens. These typically take seven to ten years to clear from your credit history, damaging your credit profile and your ability to qualify for credit or get desirable rates.

Paying your bills on time is one of the best things you can do for your credit score. Setting up online alerts or automatic bill payments across your accounts can help you keep track of your bills and remove the risk of accidentally missing a payment.

Amounts owed and credit card utilization – 30%

Credit utilization – also known as debt-to-limit ratio – measures the amount of your overall credit card limit that you are using. Staying below 30% is a good goal2, but the lower the better. A high credit utilization signals to lenders that you’re overextended and may not be able to handle more credit.

Your credit utilization ratio is calculated by dividing your total outstanding balances on all of your cards by your total credit limit. Credit card issuers typically report your payment and utilization information based on billing cycles and not real time, so your credit score may not reflect the most recent updates to your credit card balance and credit limit. To learn more about your score and your utilization ratio, sign up for Upgrade’s Credit Health tool.

Established credit history and average age of credit lines – 15%

Establishing a long credit history usually helps your credit score as long as you have a consistent history of on-time payments on your open accounts. Factors that are considered include how long your credit accounts have been open (the age of your oldest account, the age of your newest account and an average age of all your accounts), how long specific credit accounts have been established and how long it has been since you used each account.

You can’t change when you first opened your first credit card, but keeping your oldest credit card open could help. Unless you’re paying high fees or find that you’re racking up too much debt, it’s probably best to keep that first card open. Closing your first credit card could mean shortening your credit history and reducing your available credit, which could lower your credit score.

Credit Mix and Number of Accounts in Use: 10%

The number and mix of credit accounts that you have in use – credit cards, auto and student loans, mortgages and other lines of credit – all contribute to your credit score. Generally, having more open credit accounts translates into better credit scores. Why? Having more accounts means you’ve been approved for credit by more lenders. Additionally, having a diverse mix of credit across the two main categories – revolving credit and installment loans – can increase your credit score:

- Revolving Credit: credit products such as credit cards or home equity lines of credit (HELOCs) in which you make different payments each month depending on how much credit you utilize

- Installment Loans: loans with terms of fixed payments made over a fixed timeline with fixed rates

Hard Credit Inquiries and New Credit – 10%

Each time someone pulls your credit report — a lender, landlord, or insurer — an inquiry is documented on your credit report. One hard inquiry is unlikely to affect your score more than a few points, but they can stay on your credit report for two years. However, many hard inquiries or opening several new lines of credit in a short period of time can be more detrimental.

Lenders who see that you have numerous recent inquiries may worry that you are applying at several places because you’re unable to qualify for credit or may be desperate for money. According to FICO, research shows that consumers opening multiple credit accounts in a short timeframe indicates greater risk – especially those who don’t have a long credit history.3 To keep you credit score up to par, you should avoid applying or opening several lines of credit at once.

Bottom Line

Reading your credit report for the first time may feel like information overload, but learning what makes up your credit report and how each item affects your credit score can help you prioritize the steps that can be most impactful to improving your credit health.