Maximize your rewards with a $1,000 monthly direct deposit

Even more benefits with $1,000 monthly direct deposit²

Higher Rates (APY) on Savings³

Add a Performance Savings account when you open your checking account to earn up to 4.02% APY.³

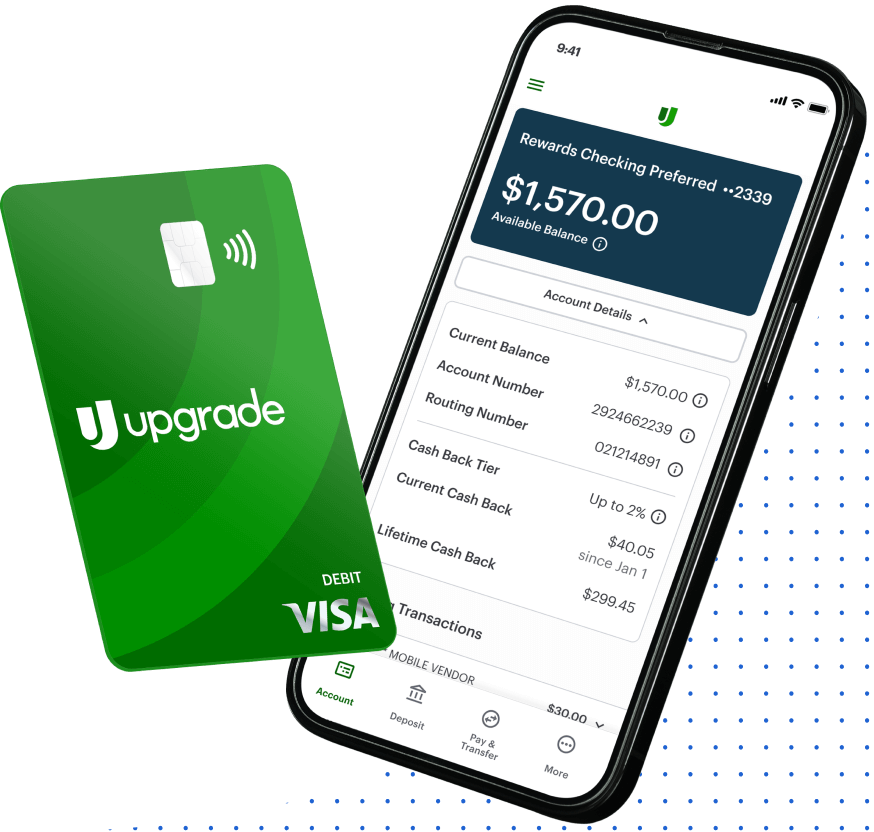

Up to 2% Cash Back¹

On common everyday expenses, recurring payments and subscriptions.

Mobile Check Deposits

Deposit checks right from your mobile phone.

Lower Rates on New Loans & Cards⁴

10%-20% lower interest rates on loans & cards through Upgrade.All customers enjoy

Get paid up to 2 days early with direct deposit⁵

Pay bills, go shopping, or have a night out!

No Overdraft Fees⁶

We have safeguards to prevent you from overspending, but on the rare chance it happens, we won't charge you any fees.

No Monthly Maintenance Fees

No recurring fees just to access and manage your account.

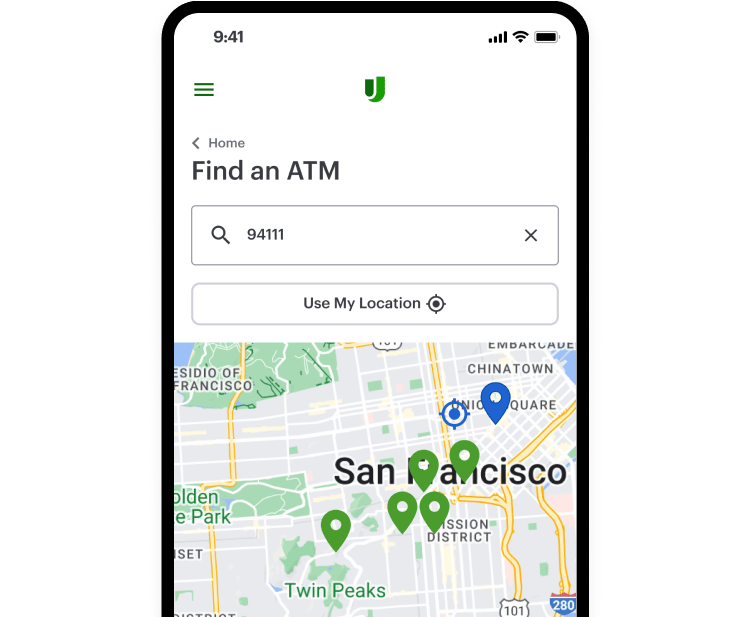

Allpoint ATM Network

Access your money easily at over 55,000 fee-free⁹ ATMs.Reach your goals faster with a Performance Savings Account

Pair Performance Savings with Rewards Checking PreferredNational savings average

Rewards Checking Preferred

With performance savings3

Rewards Checking Preferred

With performance savings + $1000 direct deposit3

Joint Accounts New

New Rewards Checking Preferred and Performance Savings accounts are available as a joint account for two account holders. To open a joint account, select this option when starting your application.

Smart Transfer Tools

- Put your savings on autopilot by moving a portion of your paycheck directly into your Performance Savings account.

Save My Paycheck

- Avoid bill payment failures8 due to insufficient funds with this tool that automatically pulls money from your savings account when your checking account balance is lower than the amount due for scheduled payments.

Bill Pay Guard

- Create custom rules to transfer money between your checking and savings accounts whenever your balance crosses a specific threshold.

Auto Balance

Allpoint® ATM Network

Explore our expansive fee-free ATM network9 through our partnership with Allpoint®, featuring over 55,000 locations nationwide. Conveniently access your cash without fees at popular retail spots like Walgreens® and CVS Pharmacy®.From our customers

”Amazing helpful place with easy self service! 100% recommend these guys to anyone looking for help.”

From Upgrade Customers

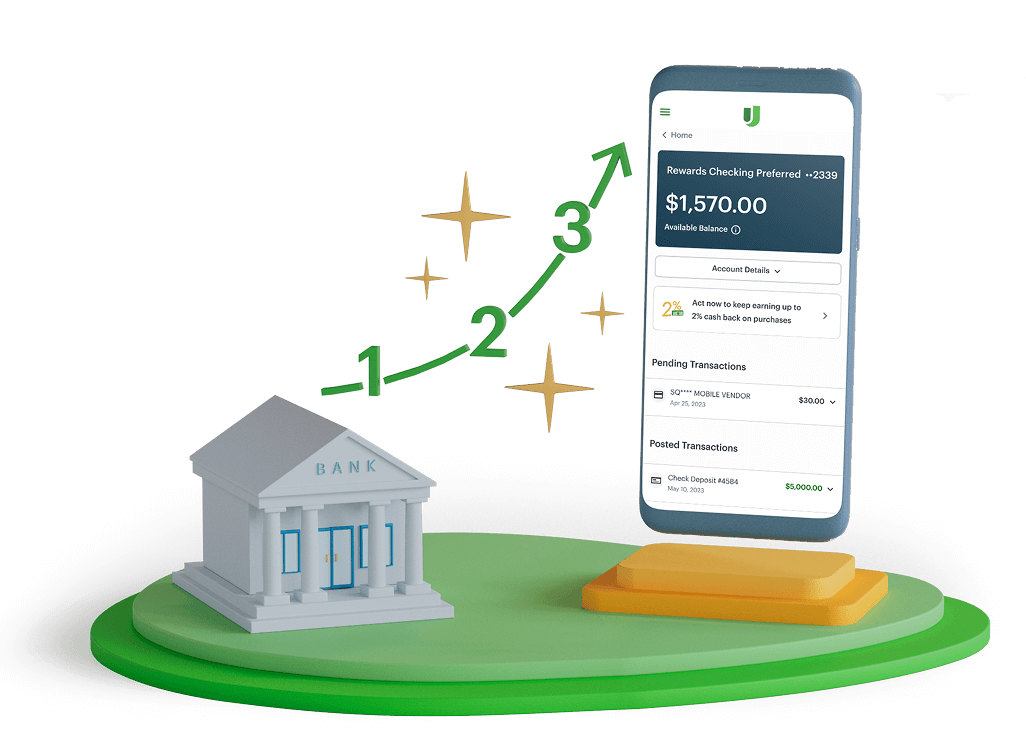

How it Works

Apply for an account online in just a few minutes.

Fund your account with the click of a button or set up direct deposit to have your paycheck deposited automatically each pay period.

Use your Rewards Checking Preferred debit card anywhere Visa® is accepted and earn up to 2% cash back.¹