Get the money you need for unexpected expenses

- Get up to $50,000 with a low, fixed rate loan

- Affordable monthly payments

- No prepayment fees

- Fast funding†

Checking your rate is free and won’t impact your credit score.

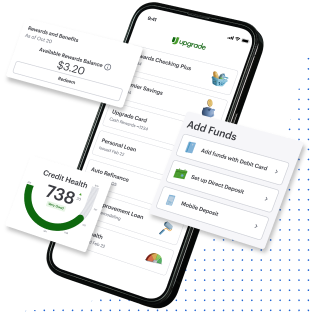

Get $200 with Rewards Checking Preferred

when you also open an account and direct deposit at least $1,000**Get $200 with Rewards Checking Preferred

when you also open an account and direct deposit at least $1,000**Cover an unexpected expense with a personal loan

Why get a personal loan for an unexpected expense?

- Find out your rate and how much you qualify for in minutes with no obligation and no impact to your credit score.

Check your rate in minutes

- You should receive your funds within a day of clearing verifications.

Fast funding†

- Low interest rates with fixed terms so you know how much to budget each month and circle the date for when you’re debt free.

Cover unexpected expenses with a low, fixed monthly payment

Personal loans that make life happen, or cover life's surprises

Whatever the problem, a personal loan can help you get your home back up and running fast.

Whatever the problem, a personal loan can help you get your home back up and running fast.Home Repairs

Get the car repairs you need with fixed-rate financing.

Get the car repairs you need with fixed-rate financing.Car Repairs

Pay for funeral expenses now and pay back the loan in affordable payments over time.

Pay for funeral expenses now and pay back the loan in affordable payments over time.Funeral Expenses

It's quick and easy to apply for a personal loan online

- Check your rate

Apply online in minutes and see your rate with no obligation or impact to your credit score.

- Choose your personal loan*

Review multiple loan options and decide which offer is best.

- Fast funding†

Accept your loan offer and you should get your money within a day of clearing necessary verifications.

Personal loans through Upgrade are flexible & customizable

Select an offer

Choose your monthly payment that won't ever change and fits your budget.

- Loan Amount

- $15,000

- APR

- 12.66%

- Term

- 36 months

- Monthly Payment

- $449.50

Fixed Rate & Term

Pick terms that fit your timeline.

A simple breakdown of a personal loan

Get to know the rates, fees and your payback plan

If you're approved for a $10,000 loan with a 17.98% APR and 36-month term...

- Your APR

The 17.98% APR includes:

14.32% yearly interest rate5% one-time origination fee ($500) - Your money

You would get $9,500 deposited directly in your account

$10,000 —

$500 = $9,500

- Your payments

And, each month you would pay back $343.33 over 36 months

What customers are saying: unexpected expense loan reviews

”One of our high interest credit cards had gotten out of hand and was siphoning funds away from our savings goals. It was a responsible step for us to set up a personal loan that will be paid off in a set time period at much less interest. Because of Upgrade, I can now see our family living debt-free.”

Unexpected Expense Loan FAQs

Need Help?

Email us at

support@upgrade.com

See if a personal loan is right for you.

Checking your rate won’t affect your credit score.