How Much Can Cash Advances Cost? Fees, Interest, and Charges Explained

Credit card cash advances can often come with higher interest rates, plus transaction and ATM fees, but there are lower-cost alternatives like BoostCash™ from Boost Money™ with no interest. For a credit card cash advance, interest may start accruing immediately, typically making them one of the most expensive forms of credit. However, there are some interest-free, required fee-free options available.

Here’s typically how much a cash advance through your credit card may cost and how to help avoid paying more in fees and interest.

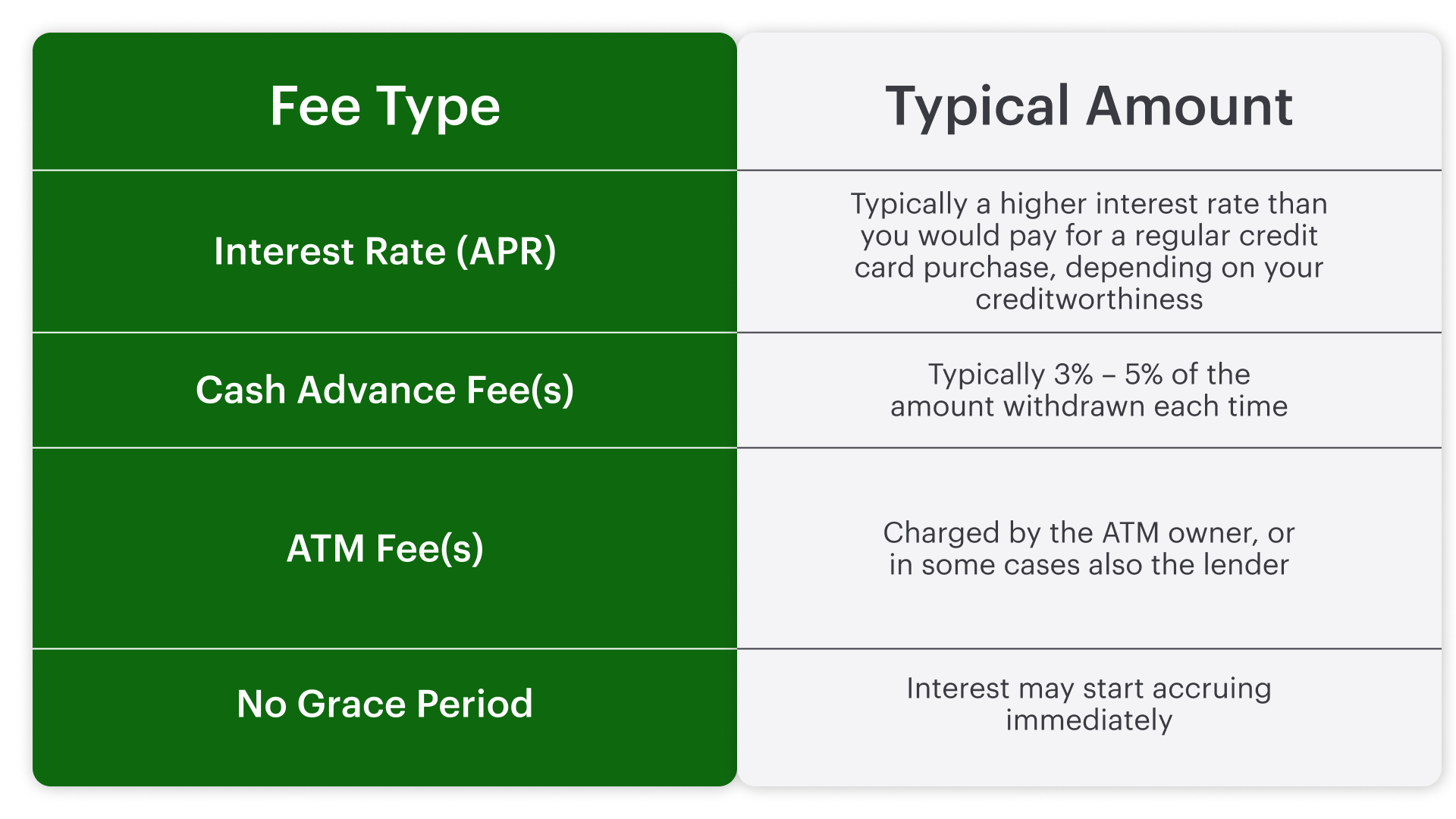

Typical Cost of a Credit Card Cash Advance

Cash advances come with multiple components of cost. Here’s a breakdown of what you can generally expect with a cash advance through your credit card:

Example: If you take a $300 cash advance with a 29.99% APR and a 5% fee, you’ll pay $15 in fees up front and about $7.50 in interest after just one month. That’s over $20 to borrow $300 for 30 days. Compare that to $0 in fees and interest with BoostCash™, if you’re eligible.

*According to Experian as of April 4, 2024. Interest Rate and APR source: Consumer Financial Protection Bureau. Cash advance fee percentage estimate source: Experian.

Why Are Credit Card Cash Advances So Expensive?

Unlike regular credit card purchases, cash advances are treated as high-risk loans, which is why many come with:

- Higher interest rates, sometimes 20% or more

- No grace period, so interest typically starts the moment you get the cash

- Separate transaction fees, sometimes added directly to your balance, or deducted from your advance

Hidden Costs to Watch Out For

In addition to the standard fees with typical cash advances, you might also face:

- Compound interest: Interest calculated on both the principal (the cash advance) and the previously accumulated interest

- Over-the-limit fees: If you exceed your credit card’s cash advance limit

- Foreign transaction fees: If you get a cash advance outside the U.S.

These charges vary widely by issuer, so it’s important to always read your credit card’s terms and conditions before taking a cash advance.

An Alternative: Boost Money™ BoostCash™

Unlike a traditional credit card cash advances, cash advances through Boost Money™, or BoostCash™, have no required fees or interest and can help you bridge short-term income gaps.

Is a Cash Advance Worth the Cost?

A cash advance can be helpful in emergencies where no other funds are available. However, it can come with high costs, depending on the type of cash advance, if you’re not careful.

It may be an option if:

- You need cash urgently and have no emergency funds available

- You can repay the full amount in a matter of days, not weeks, or months

- It is interest-free, like BoostCash™ through Boost Money™

It’s usually not worth it if:

- You’re using it to pay off other debt or make non-essential purchases

- You don’t need money urgently

FAQs About Cash Advance Costs

Do cash advance fees vary by credit card?

Yes. Each credit card has its own terms, conditions and fees associated with a cash advance, and some charge flat fees while others use a percentage of the amount withdrawn each time.

Can I pay off a cash advance early?

Absolutely, and you should if you can. Paying it off as quickly as possible may help minimize interest charges, if there are any. Always double check with your lender or cash advance provider that you won’t be charged for early repayment. With BoostCash™, you can pay off your advance early without penalty, but your repayment due date also generally aligns automatically when your next paycheck arrives.

Do cash advances hurt your credit score?

Not directly in some cases, but if they increase your overall credit utilization or lead to missed payments, they can negatively impact your credit score.

Final Takeaway

Traditional cash advances can come with steep costs like high interest and immediate fees for each advance. But BoostCash™ through Boost Money™* offers a smarter option: flexible access to cash without any required fees or interest. Learn more about BoostCash™ and get started today.

*BoostCash™ personal loans (“BoostCash™ advances”) range from an initial $25 and up to $500 over time for eligible Boost Money™ Spend customers, subject to eligibility requirements at upgrade.com/boostcasheligibility, including eligible direct deposits, and approval. If eligible, your BoostCash™ advance amount can increase over time based on several factors, such as positive repayment history. If any eligibility requirement is waived, subsequent BoostCash™ advances are subject to all eligibility requirements and approval. BoostCash™ advances made through Upgrade feature Annual Percentage Rates (APRs) of 0.00% and a term of up to 34 days. For example, a $25 BoostCash advance with a 14 day term and a 0% APR has a required single installment payment of $25 on your due date. BoostCash™ advances are generally repaid in full on the date of your next expected payroll or employer direct deposit and are repaid automatically from your Boost Money™ Spend account or, if your funds are insufficient for repayment, any deposit account you have opened through Upgrade on your Due Date. Delivery may take 3-5 business days without Premium or within minutes with Premium Subscription express delivery ($9.99/mo). Funds availability depends on the receiving bank. You must repay a BoostCash™ advance before you may get a new one. BoostCash™ advances are not available in all states. See BoostCash™ Account Agreement for details.