Learn more about Flex Pay

How Flex Pay works

Shop

Add items to your cart or itinerary

Choose Flex Pay

Select Flex Pay as your payment method

Apply

Apply and receive your decision in minutes

Enjoy!

Travel or enjoy your purchase now and pay later

Flex Pay, gives you the freedom to purchase what you want now and pay over time with simple fixed installments offered through its bank partners. Some plans include interest while some are interest-free.

When you’re ready to check out, just select Flex Pay as your payment method, complete a short application, and receive a quick decision. If approved, choose the terms of your payment plan, finish checking out, and enjoy your purchase. Then, pay over time with simple, no-surprise monthly payments.

Flex Pay lets you spread the cost of your purchase over low, monthly payments in the form of a short-term, fixed interest loan.

Just shop like you normally would. When you are ready to check out, simply select Flex Pay as your payment method.

To apply, you’ll need to provide some basic information like your mobile number and date of birth. If you’re approved, select your offer, finish checking out and you’re done.

You may continue to see Uplift on your bank statements for a period of time while we finalize the brand name change. Don’t worry, this is normal, but if you’d like to talk to our customer support team members about any concerns, please don’t hesitate to reach out to customercare@upgrade.com or call us at (844) 257-5400 between 5:00 AM to 7:00 PM (PST) seven days a week.

Loans are issued by these lending partners.

While some credit cards charge interest on interest, a loan through Flex Pay charges only simple interest. If you carry a balance on a credit card, it can be hard to understand what it will cost you. With Flex Pay, the cost is clear at the time of purchase, with simple interest, predictable payments, and no fees.

Yes! You are free to travel or check in whenever you like - even before you're all paid off.

When paying for a hotel booking with Flex Pay, your loan will cover your room rate, taxes, fees and add ons listed on the booking confirmation page.

While we never charge any fees, your hotel may charge additional fees during your stay for amenities such as resort fees, parking, and WiFi. For more information, please review the hotel’s website or contact the hotel directly.

With some merchants, you can use Flex Pay to purchase travel on behalf of someone else. A travel provider who has this feature enabled will be indicated with a dropdown option for “new applicant” during the application process.

You’ll need to initiate any cancellations with the travel provider first. If the travel provider’s cancellation policy allows for a refund, we’ll update your account after the cancellation is fully processed. If you are not eligible for a refund from the travel provider, you are still responsible for the outstanding balance and your monthly payments remain the same until your balance is paid in full.

Once we receive a refund from the merchant, we’ll apply the full amount to your account balance within 10 days.

If you receive a refund for more than the balance owed on your account, we will credit back all remaining funds to the method of payment used to make the initial payment. In the event that you no longer have that method of payment (e.g., you used a card that is no longer valid), we will work with you to issue a refund.

You’ll need to initiate any cancellation or returns with the merchant first. If you are eligible for a refund from the merchant based on their refund policy, we will apply the refunded amount to your account balance and credit back all remaining funds to your method of payment used to make the initial payment. In the event that you no longer have that method of payment (e.g., you used a card that is no longer valid), we will work with you to issue a refund through.

If you receive a refund for less than the balance owed, you are still responsible for the outstanding balance and your monthly payments remain the same until your balance is paid in full.

Our application process occurs at the time of checkout, directly through our partners’ websites. Loan proceeds are paid directly to the merchant for the purchase of goods and services.

To see if you may qualify for a loan using Flex Pay, simply shop for your items and add them to your cart just like you normally would. When you are ready to check out, select Flex Pay as your payment method.

US Residents: When you check your eligibility, a soft credit inquiry occurs to verify your identity and determine your eligibility for financing. A soft credit inquiry doesn’t affect your credit score. Flex Pay does not perform hard credit inquiries.

Canadian Residents: See here for FAQs.

The last four digits of your Social Security Number are used to verify your identity and determine your eligibility. Prior to accepting your loan, your full social security number will be required to take a loan, as required by federal banking law.

If you receive an error message or can't complete your purchase because of technical issues, you are welcome to submit a new application.

Available inventory and prices on merchant sites can change frequently and could be the reason you are unable to complete your purchase. You may reach us by emailing customercare@upgrade.com or by calling (844) 257-5400 between 5:00 AM to 7:00 PM (PST) seven days a week.

No. Applications to use Flex Pay to pay over time for merchandise or bookings cannot be submitted through voice services. Applications can be accessed on our merchant partner's websites after selecting Flex Pay at checkout, or if applying through an Agent, on mobile devices by accessing the link via email or SMS.

Our Customer Support team is available seven days a week from 5:00 AM to 7:00 PM (PST) at (844) 257-5400. You can also send us an email at customercare@upgrade.com.

We look at a number of factors, including your credit information, purchase details, and more.

Yes! You can use Flex Pay for upgrades, insurance, extended warranties, shipping, and more – it all depends on what the merchant offers at purchase. At checkout, the monthly payment amount you see reflects all eligible purchases you have in your cart.

Yes! As soon as the merchant has processed your purchase, it will be delivered to you, even before you finish making your loan payments.

Flex Pay can be used to purchase a wide range of products and services from our travel partners and retailers. Click here to see a full list of our current partners.

Flex Pay give you the freedom to purchase what you want now and pay with fixed monthly payments. Buy now, pay later is an alternative to credit cards that charges only simple interest. Buy now, pay later also makes budgeting easy so you can manage your expenses over time rather than paying one large sum all at once.

No, Flex Pay doesn't charge any fees. That includes late fees and prepayment penalties.

Yes - you can have more than one active loan at a time. Just know that each time you apply, we look at a number of factors including your credit information, purchase details, current loan activity, and more. Approval in the past does not guarantee future approvals.

No, we do not offer pre-approval. Approval occurs at the time of checkout, directly through our partners’ websites. To see if you may qualify for a loan, simply shop for your items and add them to your cart just like you normally would. When you are ready to check out, select Flex Pay as your payment method. To apply, you’ll need to provide some basic information like your mobile number and date of birth. If you’re approved, finish checking out and you’re done.

APRs may range from 0% to 36% and are based on a number of factors including your consumer credit information, purchase details, current loan activity, merchant promotions, and more.

Flex Pay is currently available throughout the United States and Canada.

Note: If you are using the mobile app, it is currently only available in the United States except for IA, WV, DC, and the US Territories.

Once we receive a refund from the merchant, we will credit it to your account within 10 days.

If you receive a refund for more than the balance owed, we will credit back all remaining funds to the method of payment used to make the initial payment. In the event that you no longer have that method of payment (e.g., you used a card that is no longer valid), we will work with you to issue a refund.

You can check your refund status by logging into the Dashboard. If there is a pending refund, you will see a notification on the account page. A posted/confirmed refund will be available in your transaction history under your loan.

Please note, loan payments due during the refund processing time are still required and interest will still accrue.

You can change your payment method by logging into the Dashboard, opening the menu, and selecting Payment Methods. We recommend that you connect your bank account - it's a more reliable method than debit card payments.

You have the flexibility to make payments in a number of different ways.

Set up Autopayautopay to make sure you never miss a payment and avoid late penalties. Just log in to your Upgrade account and set up Autopay in your dashboard.

For one-time payments that you’ll make each month, you can:

- Pay online in your dashboard

Pay by mail: send a personal check, cashier’s check, or money order.

In the US Flex Pay ℅ Upgrade, Inc. 2 N Central Ave., 10th Floor Phoenix, Arizona 85004

Pay to the order of Upgrade, Inc.

Include your Account ID number in the memo

To enroll in Autopay, log in to your Upgrade account. You can either set up Autopay when viewing your loan details or you can set it up when you go to make a payment on your loan.

To turn off Autopay log in to your online account and go to the Manage Autopay page at least one calendar day prior to the scheduled date of your next payment. This will also disable Autopay for all future payments. You can turn Autopay back on at any time.

If you're having trouble making your payments, please reach out to us before considering enrollment with a debt settlement company. We can answer your questions and discuss your options at no additional cost to you. You may reach us by emailing customercare@upgrade.com or by calling (844) 257-5400 between 5:00 AM to 7:00 PM (PST) seven days a week.

Debt settlement companies may encourage you to stop making your payments, which means your loan will accrue additional interest. For US residents, we're required by law to report all account experiences—positive and negative—to one or more of the credit bureaus. What's reported to credit bureaus doesn't change if you're working with a debt settlement company, and we still must follow our policy on good faith updates. We will still follow our charge-off policy if your loan becomes 120+ days past due.

If you're already enrolled or plan to work with a debt settlement company, please email us your authorization to release information at customercare@upgrade.com.

We understand that unexpected life events happen. If you can’t make a payment, we encourage you to call our Customer Support Team. You may reach us by emailing customercare@upgrade.com or by calling (844) 257-5400 between 5:00 AM to 7:00 PM (PST) seven days a week.

If your payment becomes more than 30 days past due, you may be subject to the following:

- If you’re a US resident, your delinquent payments will be reported as late to the credit bureaus.

- You will owe additional interest and it will continue to accrue.

- No further financing through Flex Pay will be available to you until your payments become current.

Adding your bank account is the preferred method of payment because it’s:

- More reliable! Electronic payments are a more reliable method than card payments.

- Faster! Flex Pay partners with Plaid so you can sign into your bank account for instant verification.

- Easier! Don’t worry about expiration dates or daily limits.

Customers from the United States can pay by either bank account, debit card, or check.

If paying by check, please make your check payable to Upgrade, Inc., and send it to our U.S. office address:

Flex Pay ℅ Upgrade, Inc. 2 N Central Ave., 10th Floor Phoenix, Arizona 85004

We recommend linking your bank account via Plaid to make effortless, electronic payments. Plaid ensures your information is always secure and up-to-date and you never have to worry about lost or stolen cards.

Yes! Make your check payable to Upgrade, Inc. and send it to our U.S. address:

Payable to:

Flex Pay℅ Upgrade, Inc. 2 N Central Ave., 10th Floor Phoenix, Arizona 85004

Yes, you can make additional payments to pay down your balance or pay off your purchase in full. You can pay off your loan at any time without paying a penalty or fee.

Making additional payments won't change your monthly payment amount, but it will pay off your loan sooner and decrease the total amount of interest you pay over the life of your loan.

No, there are no prepayment penalties

First, check to see if the payment method on file is up to date by visiting the Dashboard. Is the correct billing address added? Is the expiration date correct? Is the account number entered correctly? Be sure to ensure all information is up to date.

If your payment method is current and your information is up to date, please contact your financial institution to confirm that payments are not being blocked.

You may reach us by emailing customercare@upgrade.com or by calling (844) 257-5400 between 5:00 AM to 7:00 PM (PST) seven days a week.

Payments are due monthly. Your due date is available in your Dashboard. We'll also send you emails and text messages to remind you.

Your first payment will depend on your hotel's policy. You'll receive an email and an SMS once your payment schedule is ready. This could be at time of booking or closer to your check-in date.

The date of your first monthly payment is detailed on your payment schedule. If you choose a loan with a downpayment, we will also collect your down payment when your hotel requests payment from us.

You can also turn on Autopay so you never miss a payment.

You can't change when your loan payments are due, but you can delay a payment up to 15 days after your original payment date by signing in to the Dashboard. This request will not affect future payment due dates. You will be responsible for any additional interest that accrues.

Yes. We send reminders via both email and text before your monthly payment is due.

You can also turn on Autopay so you never have to worry about missing a payment.

A payment may fail for a variety of reasons. If your payment was not processed, sign in to your account and Payment Methods. There, you can verify that the payment method on file is correct and up-to-date, or add a new payment method.

Just like any loan, there can be severe consequences for not staying current or fulfilling the terms of the loan. Flex Pay reserves the right to report payment delinquencies of 30 days or longer to one or more consumer reporting agencies in accordance with applicable law.

We understand that there can be unexpected life events so we encourage you to call our Customer Support Team and speak with us about your situation. We will do everything we can to help you.

You may reach us by emailing customercare@upgrade.com or by calling (844) 257-5400 between 5:00 AM to 7:00 PM (PST) seven days a week.

Please contact fraud@upgrade.com immediately. You are protected from purchases made without your authorization. We understand how concerning this can be and we are committed to helping you resolve the situation.

To report fraudulent activity, please submit the following documentation:

- FTC Identity Theft Affidavit – this form must be printed and notarized.

- A police report that was filed with your local jurisdiction.

Please send copies of both documents to us via email at fraud@upgrade.com or by mail to:

Flex Pay Upgrade, Inc. 2 N Central Ave., 10th Floor Phoenix, Arizona 85004

To report identity theft, please click here.

To report card theft, please click here.

For information about how to protect yourself against identity theft and how to respond if it happens, visit Identity Theft at USA.gov.

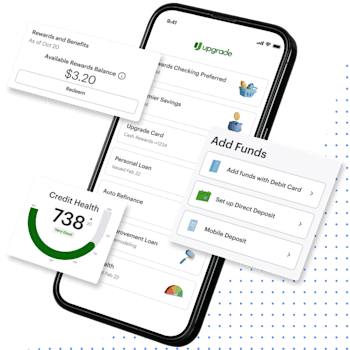

Just log in to the Upgrade dashboard to access your account. Once you're in the dashboard, you'll be able to see each of your Flex Pay loans along with any other Upgrade products you may have.

You can also access your account through the Upgrade app.

Just log in to the Upgrade dashboard to view your loans and payment history.

You can also access your account through the Upgrade app.

You can update your personal information in the Account Settings after logging into the Upgrade Dashboard.

For additional assistance, contact the Upgrade Customer Support team by calling (844) 257-5400 between 5:00 AM to 7:00 PM (PST) seven days a week.

If you aren't getting any emails from Flex Pay, please check your ‘Spam’ or ‘Junk’ folder. If you still don’t see emails from us, you may reach us by emailing customercare@upgrade.com or by calling (844) 257-5400 between 5:00 AM to 7:00 PM (PST) seven days a week.

You can change your payment method by logging into the Dashboard, opening the menu, and selecting Payment Methods.

We recommend that you connect your bank account- it’s a more reliable method than debit card payments.

If you need to verify your identity, please click here

Loans obtained through Flex Pay by Upgrade and Retail Installment Sale Contracts assigned to Upgrade comply with the Servicemember Civil Relief Act (SCRA).

Under SCRA requirements, benefits include an interest rate reduction for active-duty military servicemembers. Please note that to be eligible for the interest rate reduction, the loan must be obtained prior to the active-duty start date and we may request documentation to determine your SCRA eligibility.

The Military Lending Act provides important protections to members of the Armed Forces and their dependents relating to extensions of consumer credit. If you’d like to learn more, call our MLA hotline at (855) 511-7676.

To report bankruptcy, please click here.

To report the death of a borrower, please click here.

Flex Pay offers access to no-interest and simple interest loans, which means that the interest is paid only on the principal of the loan, and not on any interest from previous periods of the loan.

All loans through Flex Pay are fixed-rate.

No. You cannot use a co-borrower.

Shop for your items and add them to your cart just like you normally would. When you are ready to check out, simply select Flex Pay as your payment method. To apply, you’ll need to provide some basic information like your mobile number and date of birth. If you’re approved, finish checking out and you’re done.

Some banks show multiple items on your account for your first payment. The first charge you see on your account is a pre-authorization and should go away automatically without resulting in a charge. The second is the actual charge to your account.

If the items on your account persist for many days, please contact our Customer Support Team. You may reach us by emailing customercare@upgrade.com or by calling (844) 257-5400 between 5:00 AM to 7:00 PM (PST) seven days a week.

A finance charge is any fee paid to the lender for the cost of borrowing. This charge can include a one-time fee, such as an origination fee, or interest accrued on the loan amount. Flex Pay does not charge fees, only interest.

Loan terms are non-negotiable.

Unfortunately, we can't make exceptions. Loan offers are based on your credit information, purchase details, and other factors.

If you need to make changes to your purchase, please contact the merchant directly. The changes may affect your loan balance.

Yes, all loans through Flex Pay are installment loans, which means you repay the loan over time with a set number of scheduled payments. Some plans include interest while some are interest-free. Your payments are the same amount over the life of the loan and you can pay off your loan at any time without paying a penalty or fee.

After you fill out a short application, you will see your offer displayed with terms and monthly payment amount if approved.

Confirm your offer and then finish your checkout process.

No. We do not offer refinancing options.

No. The person applying for the loan may differ from the person traveling on the itinerary. When completing the application, include the information of the person to whom the loan will be issued.

In most cases, Flex Pay cannot be used for a purchase that has already been finalized. You’ll need to make a new purchase.

However, in certain cases where purchases are made in advance and then paid for incrementally, for example a deposit then a final payment, you may be able to finance the remaining balance through Flex Pay. This will not cover any payments that have already been made. Availability depends on the partner’s policy, so please refer to the partner’s terms and conditions if you plan to use Flex Pay to finance part of a completed purchase.

If your application is denied, we'll send you an email with the specific reason(s) why. That information will also be available in your account.

If you are expecting a refund for your purchase, please forward your refund confirmation to us at customercare@upgrade.com. If you are expecting a credit or voucher, you can use those credits towards a future purchase. Simply continue making your monthly payments and use your credit voucher to make your next purchase when you are ready, based on your merchant provider’s guidelines.

Contact the merchant directly to return your purchase. If your return is accepted, the merchant will send us the refund and we will apply the amount of your refund to the balance of your loan. If you receive a credit rather than a refund or are charged a cancellation fee, you will still be responsible for the outstanding balance. If the refunded amount is more than your outstanding balance, we refund that money to you.

No, your monthly payment amount will not change. However, if Flex Pay receives a refund, we will apply the refund amount towards your principal balance, which may reduce the number of payments you may have to make.

You can read our Privacy Policy here and our Terms of Use here.

Credit bureaus, also known as credit reporting agencies, are companies that compile and sell credit reports. They collect credit account information about your borrowing and repayment history from a variety of sources, including lenders, public records, and collections agencies. They use that information to create a credit report, which is a statement that has information about your credit activity. Consumer Financial Protection Bureau

Lenders often use credit reports to determine whether they will loan you money and the interest rate they will offer you. Other businesses might use your credit reports to determine whether to offer you insurance, rent a house or apartment to you, or provide you with internet, utility or cell phone service.

Yes. We currently report to Equifax, Experian, and TransUnion. We only share pertinent payment history information with these credit bureaus.

You can request a copy of your credit report to verify its accuracy or if you have questions or concerns about decisions regarding your credit.

You cannot opt out of credit reporting for Flex Pay. However, you can request a copy of your credit report to verify its accuracy or if you have questions or concerns about decisions regarding your credit.

Yes, credit reporting can impact your credit score.

If you’re concerned about your credit score, we suggest turning on Autopay so you never miss a payment. To turn on Autopay, visit the Dashboard, click on the Loans tab and turn on Autopay. We also recommend setting up electronic payments directly through your bank account. There are no expiration dates or billing addresses to update and nothing to change if your card is lost or stolen.

You can always see your own credit report. Businesses and lenders can only access your credit report in certain cases, regulated by law.

You can use the links below to review the laws that apply to your country of residence.

Or call us at

(844) 257-5400