Triple Cash Rewards

3% Cash back

on home, auto and health purchases1- No annual fee

- Credit lines from $500 to $25,0002

See if you have an offer with no impact to your credit score

$200 bonus

when you also open a Rewards Checking Preferred account and make 3 debit card transactions3$200 bonus

when you also open a Rewards Checking Preferred account and make 3 debit card transactions3Get unlimited cash back on purchases1

3% cash back on these qualifying categories

Home

Hardware, Home supply, Landscaping Services, Heating, Plumbing, A/C…

Merchant examples:

Home Depot, Lowe’s, Menards, Wayfair, IKEA, and more.

Auto

Automotive parts, Car dealers, Car washes, Tires, Towing Services…

Merchant examples:

Tractor Supply Co, Discount Tire, Firestone, Tires.com, Mavis Tire, and more.

Health

Health and Beauty Spas, Gym memberships, Exercise equipments…

Merchant examples:

Walgreens, CVS, Academy Sports, Dick’s Sporting Goods, MidwayUSA.com, and more.

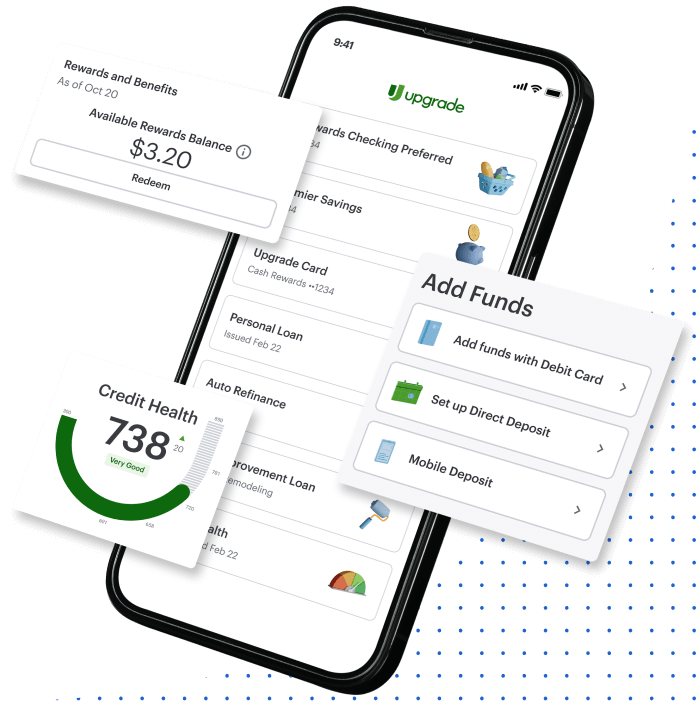

You´re in control with Upgrade Card

Combine the flexibility of a cash back rewards credit card with the predictability of a personal loan

- Swipe, tap, insert or purchase online anywhere Visa4 is accepted to get rewarded with up to 3% cash back1

Convenient

- Set payoffs bring your balance down faster so you can pay less interest

Lower cost

And, no annual fee

- Pay down balances from each month at a fixed rate on each purchase

Predictable

How it works

- Get a credit line from $500 to $25,0002

Apply for Upgrade Card

- Use your Upgrade Card anywhere Visa is accepted3

Tap, swipe, click and go

- Opt in to AutoPay for simple, automated payments

Make monthly payments

- Earn up to 3% unlimited cash back everyday on Home, Health and Auto purchases when you pay them back1

Get rewarded

Upgrade Shopping

Unlock savings on your favorite brands!

Discover offers, shop, and watch the discounts roll in.5