APR vs. Interest Rates: What’s the Difference?

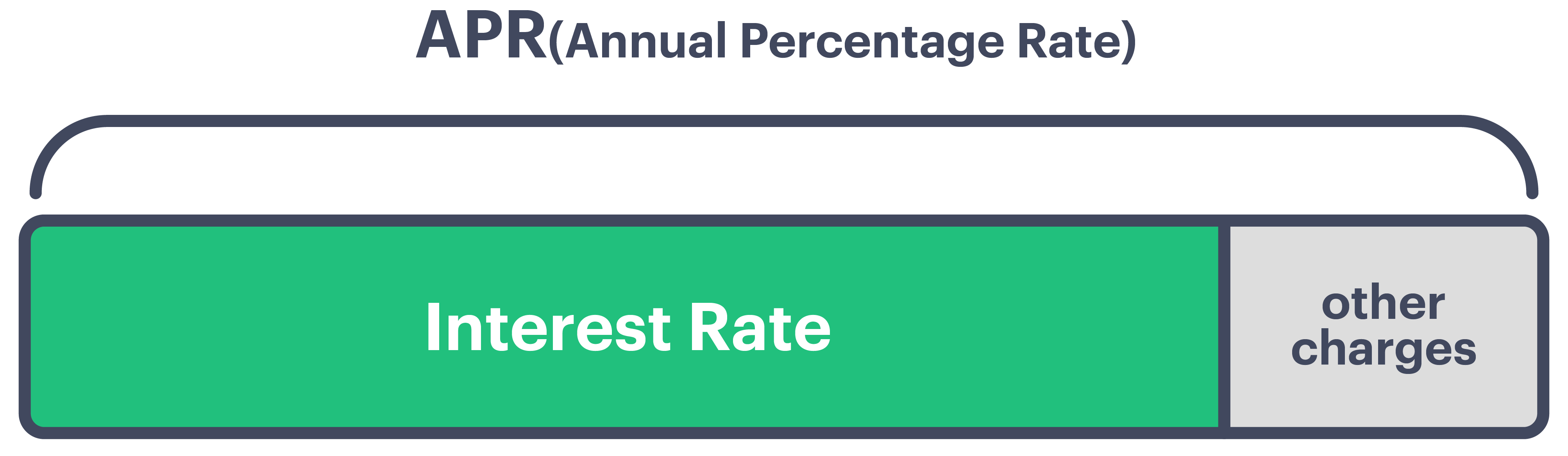

When applying for a personal loan, many borrowers focus on finding the lowest interest rate possible. While interest rate is definitely important, there’s another rate you should also be aware of: the annual percentage rate, or APR.

Both APR and interest rate provide insight into how much you’ll pay over the life of your loan, so it’s important to understand both. Here’s what to know about the difference between APR vs. interest rates.

What is “interest rate”?

Interest rate refers to the amount of interest a lender charges in exchange for giving you a loan. It’s usually expressed as an annual percentage of the outstanding principal – for example, a $5,000 loan with a 5% interest rate.

Lenders base your interest rate on a number of factors including your credit score and your debt-to-income ratio (DTI), which measures your monthly payment obligations vs. how much income you earn. Typically, the higher your credit score and the lower your DTI, the lower your interest rate will be.

Interest rate does not take into account any other fees that may be involved with your personal loan.

What is “APR”?

APR is your loan’s annual percentage rate, and it gives you the total cost of borrowing for a year. In addition to interest rate, your lender may charge fees such as an origination fee for processing your application—APR takes both fees and interest rate into account. All lenders must disclose a loan’s APR according to the Truth in Lending Act.

Pro tip: if your personal loan has no fees, the interest rate will be the same as the APR.

What is the difference between interest rate and APR for personal loans?

The difference is visible when you factor in fees. Say you’re taking out a $10,000 personal loan with a 15% interest rate and a $500 origination fee. Because of the fee, you’ll receive $9,500 in your account when you close the loan, not the full $10,000. However, your interest charges are still based on the initial loan balance of $10,000. That results in an APR of 18.67%, assuming a 3-year loan term.

We’ll break it down for you. In the illustration below, the personal loan offers below have the same interest rate, but lower origination fees for personal loan #1 results in a lower APR—and the borrower saves $400.

| Personal Loan Offer #1 | Personal Loan Offer #2 | |

| Loan Amount | $10,000 | $10,000 |

| Loan Term | 3 years | 3 years |

| Interest Rate | 15% | 15% |

| Origination Fee | 1%, or $100 | 5%, or $500 |

| APR | 15.71% | 18.67% |

| Total Interest and Fees Paid Over the Life of the Loan | $2,579.52 | $2,979.52 |

Does this mean a no-fee personal loan is always the best choice?

Not all lenders charge an origination fee, however, zero fees don’t always equal lower costs because no-fee loans may come with higher interest rates.

In the illustration below, the first loan offer comes with no fee but a 35% interest rate, while the second offer includes an origination fee but a 15% interest rate. The result is that the second loan saves the borrower $3,305.45—even with a $500 origination fee.

| Personal Loan Offer #1 | Personal Loan Offer #2 | |

| Loan Amount | $10,000 | $10,000 |

| Loan Term | 3 years | 3 years |

| Interest Rate | 35% | 15% |

| Origination Fee | 0% | 5%, or $500 |

| APR | 35% | 18.67% |

| Total Interest and Fees Paid Over the Life of the Loan | $6,284.97 | $2,979.52 |

It pays to understand interest rate vs. APR

When you’re shopping for a personal loan, always read loan documents, ask questions about additional fees and do the math. Interest rate is one way to determine your loan’s cost and monthly payment, while APR can give you valuable insight into how much you’ll be paying in fees plus interest over the term of your loan. Understanding the numbers can help you save you hundreds or thousands over the term of your loan.

View Upgrade’s Credit Health Insights for more helpful information and understand how improving your credit score can lower the cost of a loan.