Press Releases

Upgrade, Inc. Introduces Personal Credit Line

New product to combine the low cost, fixed rate and responsible credit of a personal loan with the flexibility and convenience of a credit card

San Francisco - April 10, 2018

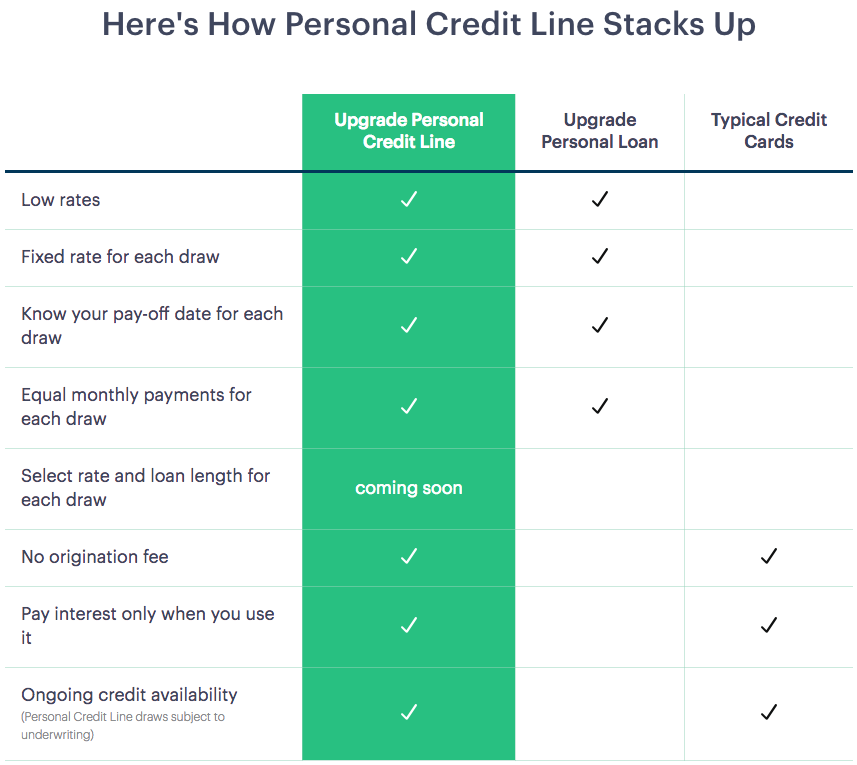

Upgrade Inc., is announcing today at the LendItFintech USA conference a new consumer product named “Personal Credit Line". The product is designed to combine the low cost, fixed rate and monthly amortization of personal loans with the flexibility and utility of lines of credit typically obtained through credit cards.

With an Upgrade Personal Credit Line, consumers can get approved for up to $50,000 and have the control to request an advance on the line when they need it, subject to credit approval. Similar to an installment loan, each advance has a fixed rate and term, making it easy to budget for monthly payments. There is no fee to open the line and no fee to use the line. Customers are only charged interest on the amount they use, and the funds are deposited directly into their bank account. Payment terms will vary from 12 to 60 months.

“At Upgrade, we’re focused on building the next generation of credit products that will help our customers maintain or improve their good credit standing and give them affordable credit so they can build a bright future,” said Renaud Laplanche, co-founder and CEO of Upgrade. “We designed the Personal Credit Line to give consumers the two things they want most: the flexibility to access funds when they need them, and the predictability of a fixed rate and equal monthly payments.”

A Personal Credit Line is useful to consumers planning for expenses over a period of time, such as a home improvement project or moving expenses or furnishing a new apartment. Unlike a home equity loan or home equity line of credit (HELOC), consumers can obtain approval for a Personal Credit Line in a matter of minutes and there is no need for collateral and an appraisal process.

“Today consumers expect transparency and flexibility in their financial life and Upgrade is leading the charge with the Personal Credit Line,” said Micky Malka, Managing Partner at Ribbit Capital and Upgrade Board member.

Personal Credit Line will be made broadly available to consumers shortly; those interested in applying or receiving updates can join the waitlist here.

About Upgrade

Upgrade is a consumer credit platform that combines access to affordable credit with credit monitoring and education tools to help consumers better understand their credit and unlock their credit potential. Upgrade employs over 250 team members and is headquartered in San Francisco, California, with an operations center in Phoenix, Arizona and an engineering center in Montreal, Canada. Upgrade does not facilitate loans to residents of Connecticut, Colorado, Iowa, Maryland, Massachusetts, Vermont and West Virginia. All loans originated through the Upgrade platform are issued by WebBank, Member FDIC. More information is available at: https://www.upgrade.com.

Recent Press Releases

![]()

Upgrade Raises $165 Million Equity Investment

San Francisco - October 16, 2025Upgrade, Inc., a fintech company that offers affordable and responsible credit and banking products to mainstream consumers, today announced that it raised $165 million in new equity investment. Upgrade’s Series G Preferred Round was led by Neuberger*, with participation from LuminArx Capital…![]()

Uplift Rebrands to Flex Pay, Reflecting Growth and Expanded Opportunities

San Francisco - December 12, 2024San Francisco, California [December 12, 2024] — Upgrade, Inc., a leading financial technology company, today announced the rebranding of Uplift, its global Buy Now, Pay Later (BNPL) solution for retail and travel brands, to Flex Pay. The rebrand marks an exciting new chapter of growth, innovation…