Media Inquiries press@upgrade.com

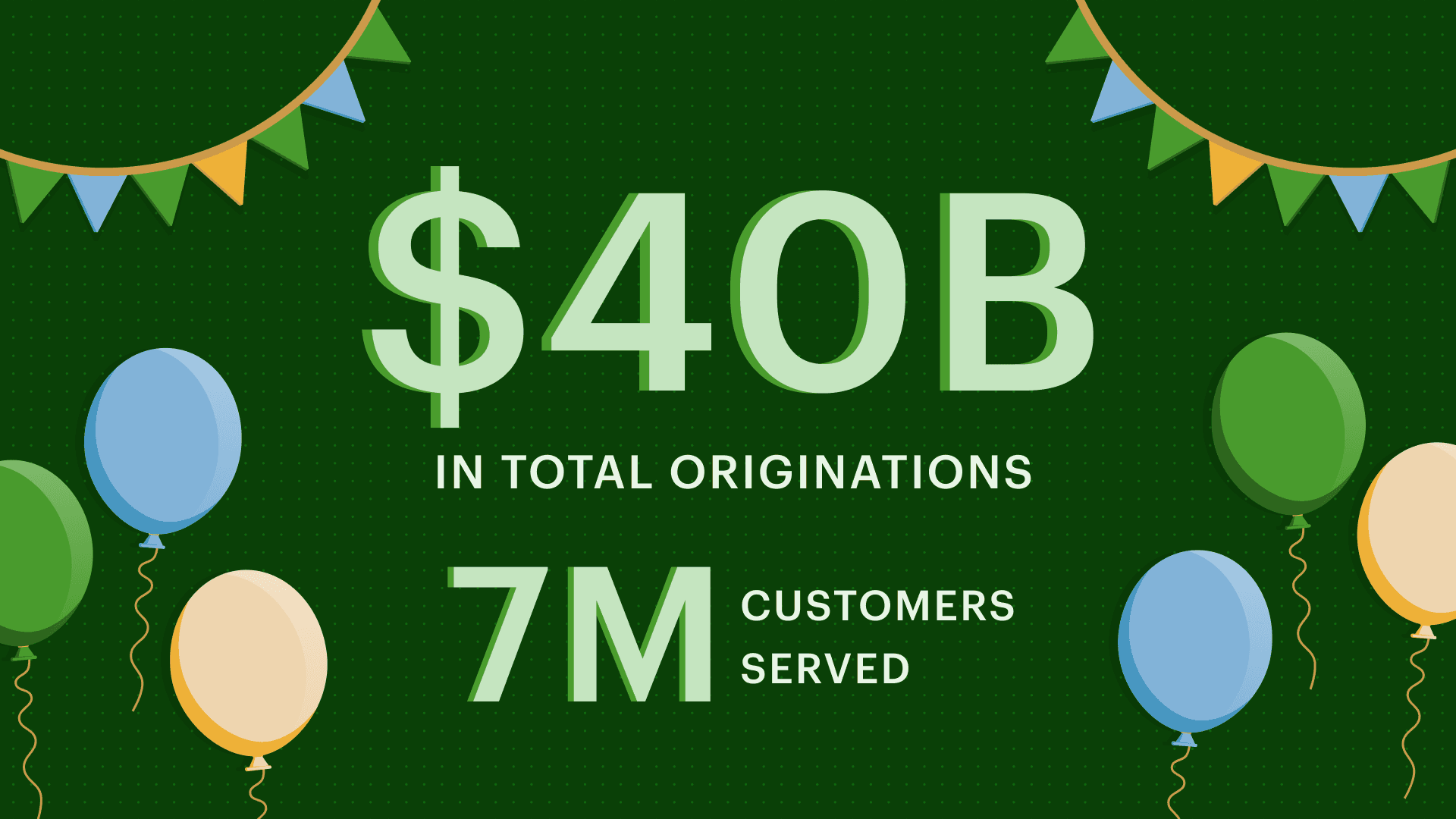

Upgrade Delivers $40 Billion of Credit to Over 7 Million Customers

Today we’re announcing we’ve surpassed $40 billion in total loan originations, serving over 7 million customers since launching in 2017.

These milestones highlight Upgrade’s consistent and rapid growth through a comprehensive suite of products and diverse distribution channels that help reach consumers directly at the point of sale through our merchant networks. Upgrade has built a platform with six core products: Personal Loans, Credit Card, Mobile Banking, Buy Now Pay Later (BNPL), Auto Financing, and Home Improvement Financing.

“Our goal is to bring responsible and affordable banking and credit products to mainstream consumers,” said Renaud Laplanche, Co-Founder and CEO of Upgrade. “We’re proud to support our customers’ everyday needs with banking products and credit cards, and be there for them during occasional life events like renovating their kitchen, buying a car, or taking their family on a trip.”

Benefits of Multi-Channel Distribution Strategy

With 6 different products at scale and multiple merchant networks to rely on (BNPL, auto, and home improvement), comprising thousands of merchants, we have the ability to onboard customers through various low-cost channels and develop our relationship with customers over time by offering them mobile banking, credit cards, and personal loans. This multi-product approach works well for our customers who benefit from having a single platform that already has all the necessary information and the opportunity for relationship discounts. It also works well for Upgrade, as it lowers customer acquisition costs while significantly increasing lifetime value and cross-product engagement.

Strong Foundation for Continued Expansion

Earlier this year, Upgrade strengthened its leadership team with the addition of Jeffrey Meiler, former CEO of Best Egg, as Chief Operating Officer to oversee personal lending and operational efficiency, Jason Swift as SVP, Operations Strategy, and Sumit Agarwal as Head of Cards.

About Upgrade

Upgrade offers affordable and responsible credit, mobile banking and payment products to mainstream consumers. Upgrade has delivered over $40 billion in affordable and responsible credit to customers since its inception in 2017. The company's headquarters are in San Francisco, California, with an operations center in Phoenix, Arizona, a technology center in Montreal, Canada, and regional offices in Atlanta, Georgia, and Irvine, California. More information is available at: https://www.upgrade.com

All loans, Personal Credit Lines, and checking and savings accounts are provided by Upgrade's bank partners. Upgrade Visa® Cards and Upgrade Visa® Debit Cards are issued by Upgrade's bank partners, pursuant to a license from Visa USA Inc. Upgrade, Inc. (NMLS #1548935) holds the following state licenses and does business under the following DBAs.

Loans made through Flex Pay (formerly known as Uplift) by Upgrade are provided by these lending partners. Uplift, Inc., (NMLS #1897458) holds the following state licenses.

Upgrade is a financial technology company, not a bank.