MyFive Cash Rewards

5% Cash back

on purchases in the category of your choice11% Cash back

on all other purchases1- No annual fee

- Check for an offer with no credit score impact

$200 bonus

when you also open a Rewards Checking Preferred account and make 3 debit card transactions2$200 bonus

when you also open a Rewards Checking Preferred account and make 3 debit card transactions25% cash back rewards in the category of your choice1

Choose your 5% category each month

Groceries

Merchant examples:

Kroger, Publix, Meijer, Safeway, and more.

TV, Internet and Streaming Services

Merchant examples:

Netflix, Spectrum, Comcast, Spotify, and more.

Dining

Merchant examples:

McDonald's, Starbucks, UberEats, Waffle House and more.

Gas and EV Charging Stations

Merchant examples:

Shell, Exxon/Mobil, Chevron and more.

Travel

Merchant examples:

American Airlines, Marriott, Hilton, Delta Airlines and more.

Cell Phone Providers

Merchant examples:

AT&T, T-Mobile, Verizon Wireless, Sprint and more.

More 5% cash back categories

1% cash back on all other purchases

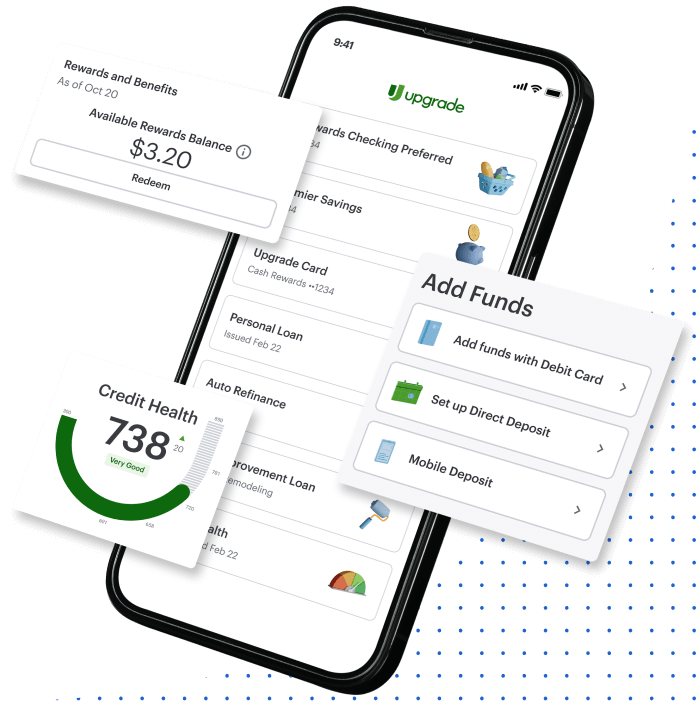

You´re in Control with Upgrade Card

Convenient

Swipe, tap, insert or purchase online anywhere Visa3 is accepted to get rewarded with up to 5% cash back in the category of your choice1

Lower cost

Set payoffs so you can bring your balance down faster so you can pay less interest

And, no annual fee

Predictable

Pay down balances from each month at a fixed rate on each purchase. Or pay no interest when you pay your full balance early4

How it works

Apply for Upgrade Card

Check for an offer with no credit score impact

Tap, swipe, click and go

Use your Upgrade Card anywhere Visa is accepted3

Make monthly payments

Pay no interest when you pay your full balance early4

Get rewarded

Earn up to 5% cash back on purchases when you pay them back1

Lower Cost than Traditional Credit Cards

Each Upgrade Card balance has a fixed rate and term so you know when you pay off your balance and can save on interest. Traditional credit cards can keep you in debt with minimum payments that pay back little of the principal balance.

Bring your balance down faster to pay less interest

Interest paid on a $5,000 balance with Upgrade Card vs. Traditional Credit Card when making a monthly minimum payment

| Upgrade Card | Traditional credit card | |

|---|---|---|

Monthly payment

| $196.13iii | $145.83i

|

Time to pay off the balance

| 3 yearsiii | 23 yearsii

|

Interest paid over that time

| $2,060.20iii | $8,929.28ii

|

Upgrade Shopping

Unlock savings on your favorite brands!

Discover offers, shop, and watch the discounts roll in.5