The High Cost of Having Bad Credit

If you’ve ever applied for an apartment, an auto loan, or a credit card, your credit score has played a role in your approval process. Businesses and institutions use your three-digit score to better understand your financial history. Having a good credit score can improve your chances of being approved and, ultimately, give you more control over your future.

On the other hand, having a bad credit score can severely limit your access to credit, as many lenders and financial institutions factor in your credit score as part of the approval process. Not only can a bad credit score affect your future financial decisions, but it can hurt your wallet, too. Let’s take a look at a few ways that having bad credit can cost you money.

Higher Interest Rates

Interest rates refer to the amount of interest a lender or financial institution charges you in exchange for giving you a loan or line of credit. Interest rates are usually expressed as percentages. Depending on how large your balance is, that rate can make a huge difference in how much extra you’re paying in interest.

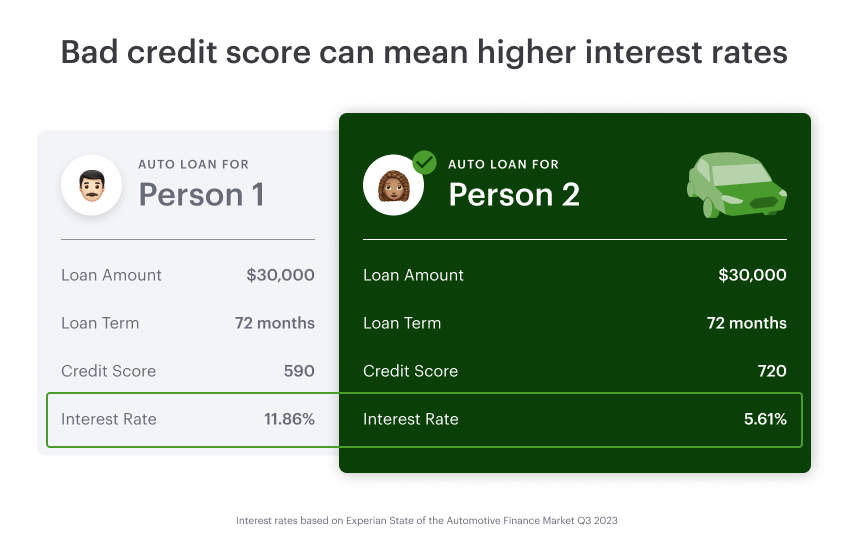

When you apply for a loan or a line of credit, lenders base your interest rate on several factors, including your credit score and debt-to-income ratio. Generally, the lower your credit score, the higher your interest rate. Maintaining a good FICO credit score (658 - 739) is key to securing a lower interest rate. A poor credit score can dramatically increase your interest rate. According to Experian’s State of the Automotive Finance Market Q3 2023, the average new car auto loan rate for subprime (501-600 credit score) borrowers was 11.86%. Here’s an example of just how much a bad credit score can affect your interest rates:

Higher Payments Could Mean Spending More Money Over Time

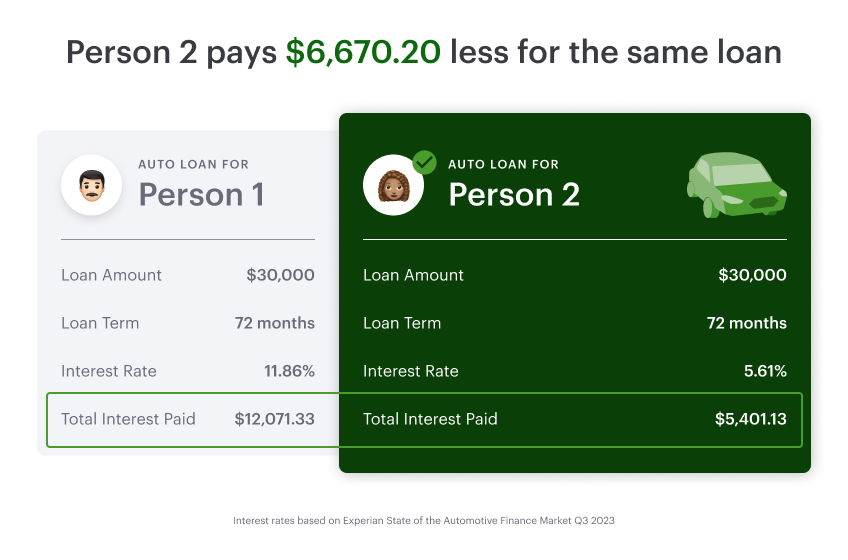

Higher interest rates mean you could be paying more money on each payment. Those payments add up and can cost you more money over the long term. The additional amount you’re spending in interest might seem relatively small, but add those payments up and you��’ll notice how much more money you’re “giving away” due to that higher interest rate.

In the example above, you can see that it costs Person 1 $6,000+ more than Person 2 for the same exact loan amount and term—all because of their credit score. When you consider how that $6,000+ could have been used (making on-time payments, paying off additional debts, or making essential/emergency purchases), you can see how a bad credit score can limit your options financially over the long term.

Higher Insurance Premiums

In addition, your insurance can also be more expensive if you have a bad credit score. For example, many auto insurance companies use credit-based insurance scoring, which differs slightly from credit scores. According to the Insurance Information Institute (III), credit-based insurance scores use factors like your payment history and the age of your credit history (the same factors that affect your credit score) to assess your insurance risk level. The practice of credit-based scoring is banned in Massachusetts, Hawaii, Michigan, and California, but it’s legally allowed in any other U.S. state. While it’s not always the case, it is possible that having a poor credit score could lead to you having a higher insurance premium.

Cash Deposits for Certain Services

Your credit is an important factor that service providers consider, and many of them will check your credit score before starting your service. Some companies, like cell phone service providers or utility companies, may require you to put down a large cash deposit if you have poor or bad credit. Doing this creates a safeguard that they will get compensated if they take a chance on a customer with a poor credit score. Improving your credit score before applying for services like these can save you money and help you avoid paying a deposit.

Tips to Improve Your Credit Score

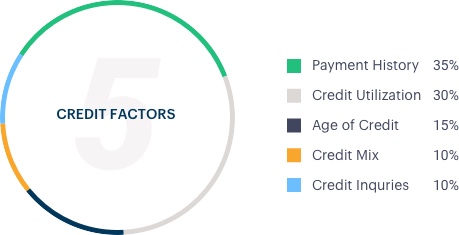

Understanding what affects your credit score helps you know what you can and cannot control. That three-digit number isn’t just magically generated; 5 major factors can impact your score. Credit bureaus have access to information about any changes (good or bad) you make to your financial situation. So, it’s up to you to make positive changes to your credit history to improve your bad credit score.

Here are some tips to address each of the 5 credit score factors and get your score back on track.

1. Payment history

Your payment history—that is, a record of all the payments you’ve ever made on credit cards, loans, etc.—is a big factor that impacts your credit score. Late payments can damage your credit score because they show that you have been at risk of not being able to repay in the past. On the flip side, making consistent, on-time payments is one of the best ways to improve your credit score.

Tip: Set up automatic payments and you won’t have to worry about missing a payment. Just remember to keep your accounts funded to complete those automatic payments.

2. Credit utilization

Your credit utilization ratio measures the balances you owe on each of your credit cards relative to the cards’ credit limits. A high credit card utilization, or spending a large amount of your credit limit, is one factor that could bring your credit score down. An ideal credit utilization ratio is below 30%; keep it under that and your credit score could improve.

Tip: Pay down your balance to decrease your credit utilization ratio. If you don’t have the means to pay it down right now, you can consider refinancing your credit cards. This could potentially lower your interest rates and make your monthly payments more manageable so that you can focus on decreasing your credit utilization ratio.

3. Age of credit history

In general, the more established your credit history is, the better, as long as you have a consistent history of making on-time payments on your open accounts. Unfortunately, the age of your credit is one factor you only have so much control over. After all, you can’t go back in time and open an account. But the age of your credit also factors in the age of your newest account, the average age of all your accounts, how long specific credit accounts have been established, and how long it has been since you used each account.

Tip: It’s generally best to keep your oldest credit card open. Closing your oldest account may shorten your credit history and/or reduce your available credit, which could lead to a lower credit score. In cases where you’re paying high fees or have maxed out the card, you may want to consider refinancing it. But if that’s not the case for you, it’s probably best to simply keep your first card open.

4. Credit mix and number of accounts

The number and types of credit accounts that you have in use – credit cards, auto and student loans, mortgages, and other lines of credit – all contribute to your credit score. Having more accounts means you’ve been approved by more lenders, which can show future lenders that you’re a reliable borrower making on-time payments.

Tip: Consider your credit mix, and only open a new account if you can maintain it and make consistent, on-time payments. Remember that applying for credit when you can’t handle it can damage your credit score.

5. Credit inquiries and new credit

Each time you apply for credit, the lender or institution will pull your credit report. That type of credit pull will either be a soft or hard inquiry. Soft inquiries do not affect your credit score, but hard inquiries can. While one hard credit inquiry may not affect your credit score too much, multiple hard inquiries in a short timeframe can impact your credit score more significantly. Along the same lines, attempting to open many new accounts in a short timeframe can damage your credit score and potentially flag to lenders that you’re a risky borrower.

Tip: Avoid applying for multiple new accounts at once and monitor your hard inquiries through Upgrade’s Credit Health tool where you can periodically check your credit report.

Summary

Getting your credit score in a good place is key to a healthy financial future. The effects of having bad credit can limit your options and end up costing you much more money, both in the short term and the long term. Take the steps to improve your credit score and your wallet will thank you. Use Upgrade’s credit health tools to monitor your score and get free recommendations to help you get your credit score back on track.