What Is a Good Credit Score?

Maintaining a good credit score can open up opportunities for you—from qualifying for lower interest rates to moving into your dream apartment. In this article, we’ll cover the credit score ranges, the advantages of having a good credit score, and a few steps you can take to improve your credit score.

What is a good credit score?

Based on the commonly used FICO® credit score range of 300 to 850, a score of 670 to 739 is generally considered “good” and a score of 740-799 is considered “very good”. Anything above 800 is considered an “excellent” credit score. The highest credit score you can get is 850. However, the average credit score is 715, according to the most recent FICO report.

However, every lender sets their own parameters for what constitutes a “good” credit score, and some lenders may have more specific cut-offs or requirements for their particular product or service. As a result, a specific score doesn’t guarantee you’ll be approved for credit or receive the best rates, but aiming for a higher score will increase the likelihood that you’ll be offered the best terms. The credit score chat below gives you a full breakdown of the commonly used FICO credit score ranges:

FICO credit score ranges

A good credit score can help you access more opportunities and better rates, potentially saving you thousands of dollars in interest or finance charges. If your credit score isn’t up to par, check out these tips on how to get an excellent credit score.

What can you get with a good credit score?

Throughout your lifetime, there will be a variety of situations where businesses and people will factor in your credit score to help them determine if they want to do business with you. Your credit score isn’t just important if you’re applying for credit—even a prospective employer may check your credit score and your credit history before making you a job offer. Having a good credit score can also open the door to more opportunities and savings. Here are just a few examples of what a good credit score can help you get:

- An unsecured personal loan or credit card

- Your dream apartment

- A mortgage or car loan with attractive terms

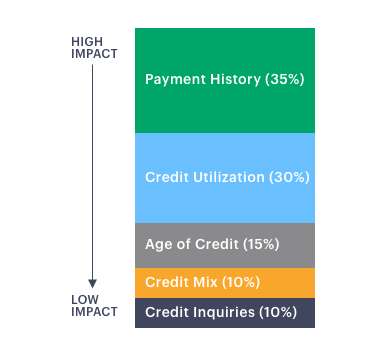

What factors into a good credit score?

Most people’s credit scores differ slightly depending on which credit bureau reports it. Your credit information may be reported and updated at different times at each bureau. And, just like there are multiple credit bureaus, there are multiple scoring models. The two most common scoring models used to calculate credit scores are FICO Score and VantageScore.

Although the proprietary scoring models behind FICO and VantageScore differ, the top factors that impact your credit score are generally the same, and it pays to know the breakdown of these factors so you can understand what it takes to get a good credit score.

Payment History

Your payment history is generally the most heavily weighted factor driving your credit score because it shows lenders that you have been reliable in making consistent, on-time payments. This is an indicator that you can responsibly handle your debts and your repayment obligations.

An excellent payment history is key to earning a good credit score. Even one or two late payments can seriously damage your credit score. Consider using features like automatic payments or real-time alerts to help you keep track of your bills and remove the risk of accidentally missing a payment.

Credit Utilization

Credit utilization measures the amount of your overall credit card limit that you’re using. A high credit utilization ratio signals to lenders that you may be overextended and unable to handle any additional credit.

Keeping your credit utilization ratio below 30% is key. If your credit utilization ratio is above 30%, it may be holding you back from achieving a good credit score. Explore different strategies for paying off debt or consider a debt consolidation loan to help streamline your monthly payments and make progress on reducing your outstanding balances. Check out this video on how to calculate your credit utilization ratio.

Age of Credit

Establishing a long credit history usually helps your credit score, as long as you have a consistent history of on-time payments. Specific factors that go into your score include: how long your credit accounts have been open (the age of your oldest account, the age of your newest account, and the average age of all your accounts), how long specific accounts have been established, and how long it’s been since you used each account.

To get a good credit score, you generally need a few years of credit history. You can’t change when you opened your first credit card, but keeping your older card open could help (unless you’re paying high fees or you find that you’re racking up too much debt). Closing your first credit card could mean shortening your credit history and reducing your available credit, which could lower your credit score. If you’re just getting started, here are some tips to build your credit from scratch.

Credit Mix

The number and mix of credit accounts that you have in use—credit cards, auto and student loans, mortgages, and other lines of credit—all contribute to your credit score. Generally, having more open credit accounts translates into better credit scores. Why? Having more accounts means you’ve been approved for credit by more lenders.

Additionally, having a diverse mix of credit across the two main categories, revolving credit and installment loans, can increase your credit score:

- Revolving Credit: credit products such as credit cards or home equity lines of credit (HELOCs) in which you make different payments each month depending on how much credit you utilize

- Installment Loans: loans with terms of fixed payments made over a fixed timeline with fixed rates

Hard Credit Inquiries and New Accounts

Each time someone pulls your credit report, a hard inquiry is documented on your credit report. One hard inquiry is unlikely to affect your score by more than a few points, but it can stay on your credit report for up to two years. Many hard inquiries (or attempts to open several new lines of credit in a short period of time) can be more detrimental. Keep in mind that checking your own credit score is considered a soft inquiry and will not lower your score.

Lenders who see numerous recent hard inquiries on your credit report may worry that you are applying at multiple places because you’re unable to qualify for credit or that you may be desperate for money. To get a good credit score, avoid applying for several lines of credit at once, and only open new accounts if you need them.

What is not included in a credit score?

Regardless of your actual credit score, the following information is not reported to credit bureaus and does not factor into your score:

- Race, color, religion, national origin, age, sex or marital status

- Salary, occupation, title, date employed, or employment history (however, lenders may consider this information in making their overall approval decisions)

- Everyday spending transactions

How can you get a good credit score?

Now that we’ve covered what goes into a good score, here are some steps you can take to get a good credit score.

- Pay on time, every time. If you have trouble keeping track of your bills, try setting up automatic payments or reminders so you can avoid an accidental late payment.

- Don’t spend up to your limit. Avoid maxing out your credit cards and pushing your credit utilization above 30%. If you have trouble reining in your spending, check out these hacks to cut back on spending, or revisit your budget.

- Monitor your credit score and review your credit report regularly. Know where you stand and what’s influencing your score. Consider signing up for a free credit monitoring service with automatic alerts so you know when something in your profile changes and you can respond accordingly.

- Keep old accounts open, if you can. Keeping your oldest accounts open can boost your score by keeping your average age of accounts as old as possible.

- Only apply for credit that you need. A few hard inquiries won’t tank your score but making a habit of applying for credit can damage it.

Ready to shoot for the stars? Check out these tips on how to get an excellent score.

Does anything else matter besides my score?

Yes. Most lenders and creditors consider factors that aren’t included in your credit score or credit report when they evaluate if they want to do business with you.

When you apply for credit, most lenders will ask for information beyond your credit report, such as your income, employment history, savings or reserves, or details about collateral. Sometimes this information is used on its own to determine eligibility. For example, an auto lender will typically require that your car has a certain resale value or a clean title.

Information from your application may be used to calculate other indicators. For example, many lenders use your debt-to-income ratio—which measures how much you owe each month compared to how much you earn—to judge your ability to manage monthly payments. Even if you have an excellent credit score, a high debt-to-income ratio suggests to lenders that you might be overextended and may have a hard time repaying additional debt.

How do I find out my credit score?

The first step to getting a good credit score is finding out where you stand. Access your credit score for free anytime with Upgrade’s Credit Health tools and see how different scenarios can affect your score. Plus, you’ll get personalized recommendations to improve it.

It’s also a good idea to review your full credit report once a year and check it for accuracy. Based on the Fair Credit Reporting Act, you are entitled to a free copy of your credit report once every 12 months from any of the nationwide credit reporting companies – Equifax, Experian, and Transunion. If you find that your credit score is being dragged down by inaccurate information, take steps to dispute the error.

Once you’ve established a good credit score, keep it that way! Keeping your score in good shape doesn’t have to be a huge undertaking. Check out these everyday habits you can implement to help boost or maintain your score. If you’re ready to shoot for the stars, learn more about how to go from a good credit score to an excellent credit score.