Get up to $50,000 with a low, fixed rate loan

- Affordable monthly payments

- No prepayment fees

- Fast funding†

Checking your rate is free and won’t impact your credit score.

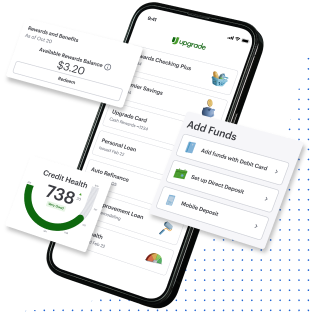

Get $200 with Rewards Checking Preferred

when you also open an account and direct deposit at least $1,000**Get $200 with Rewards Checking Preferred

when you also open an account and direct deposit at least $1,000**- Refinance credit cards

Eliminate high-interest credit card debt

- Consolidate debt

Get a single monthly payment

- Improve your home

Get the funds to remodel, repair, or build the home you want

- Make a major purchase

Get a fixed rate loan instead of a high-interest credit card

- Cover an unexpected expense

Pay for home or car repairs, and more

Best Personal Loans

”Amazing helpful place with easy self service! 100% recommend these guys to anyone looking for help.”

It's quick and easy to apply for a personal loan online

- Check your rate

Apply online in minutes and see your rate with no obligation or impact to your credit score.

- Choose your personal loan*

Review multiple loan options and decide which offer is best.

- Fast funding†

Accept your loan offer and you should get your money within a day of clearing necessary verifications.

Personal loans through Upgrade are flexible & customizable

Select an offer

Choose your monthly payment that won't ever change and fits your budget.

- Loan Amount

- $15,000

- APR

- 12.66%

- Term

- 36 months

- Monthly Payment

- $449.50

Fixed Rate & Term

Pick terms that fit your timeline.

A simple breakdown of a personal loan

Get to know the rates, fees and your payback plan

If you're approved for a $10,000 loan with a 17.98% APR and 36-month term...

- Your APR

The 17.98% APR includes:

14.32% yearly interest rate5% one-time origination fee ($500) - Your money

You would get $9,500 deposited directly in your account

$10,000 —

$500 = $9,500

- Your payments

And, each month you would pay back $343.33 over 36 months

Personal loan FAQs

Need Help?

Email us at

support@upgrade.com